How to screw up set up a MedTech startup

How to screw up set up a MedTech startup

Introductory remarks

Margaret Atwood used the proverb “What you don’t know can’t hurt you”, but she added the comment “… a dubious maxim; sometimes what you don’t know can hurt you very much”!

Why I use this statement relates directly to my background. I have seen a lot and done a lot; from my lowest point i.e. working with Theranos, to my highest, working with

highly driven commercial teams in Pfizer. Age has provided me with experience which hopefully can be translated into knowledge.

As a general statement, healthcare technology startups are very different than other industry startups. This in part due to the complexity of this industry, but it is mostly

due to the amount of money that this industry requires. The huge amounts of money required to bring an innovation to the market make things very, very difficult for startups.

Add to this the challenges of the regulatory environment and the customers’ unrealistic expectations, this makes everything more challenging!

What is the major feature that determines success or failure in a startup?

Like all startups, it begins with the people.

A diverse range of expertise is required including science, engineering, operations, regulatory, reimbursement, sales and marketing, HR, etc… and no one person can fulfil all

of these different skill sets. Keep in mind, most startups are generated from a technology that is “created” by an academic and/or an engineer; even more frightening!!

The various stages of eventually capturing a successful market depend on strict regulations, complex clinical trials, customer adoption, reimbursement, stakeholder engagement, let alone the technology.

And here lies the major problem with many of the MedTech startups I have met with, the technology is not really that relevant!

I didn’t fully appreciate this until I worked at Pfizer’s commercial HQ where I learnt about the “business of healthcare”. No startup is capable of standing up against a large

corporation, in part because of their outreach due to sales force, and also because of their established reputation.

An example of this challenge is an Australian startup working in pharmacogenomics that had a very good test with proven advantages over its large global competitor. However,

the competitor company was established and had a sizeable sales force and the startup never managed to take market share away from them.

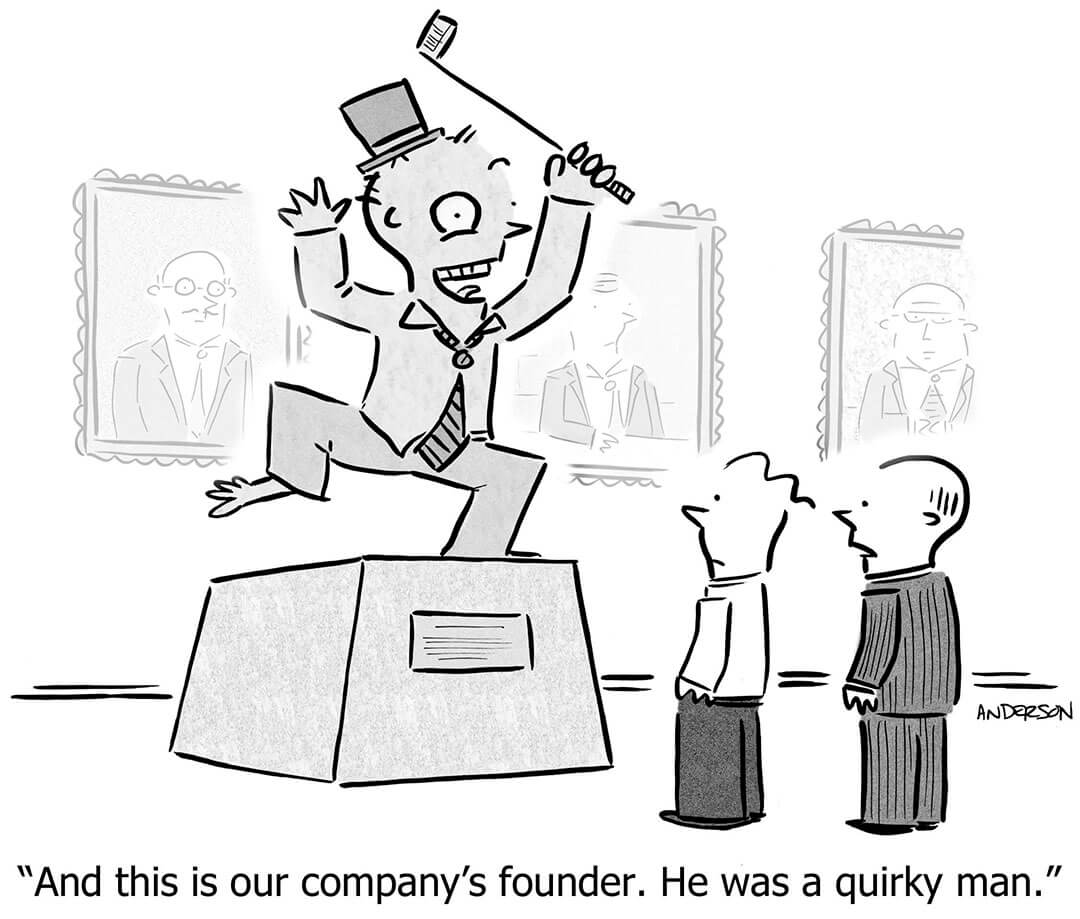

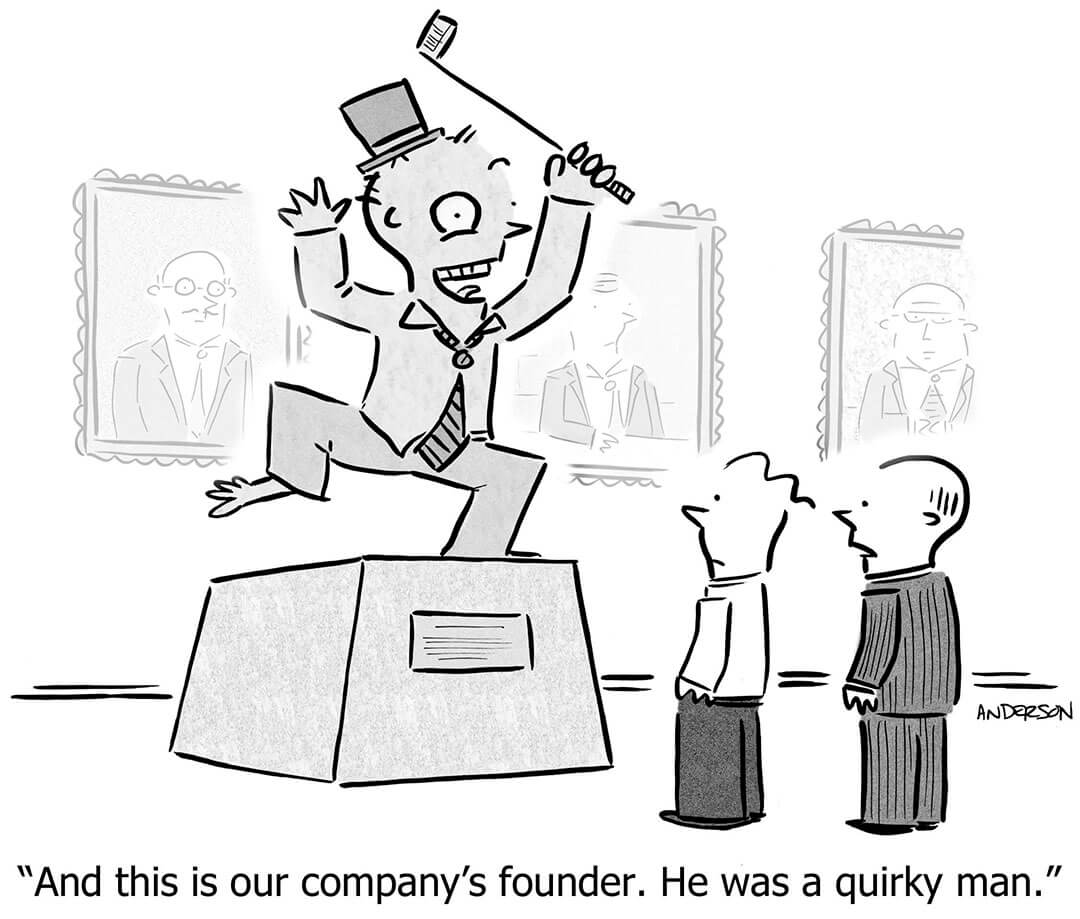

On another note, many Founders are “enamoured” with their technology. The consequence is an environment where there are numerous companies, including some listed companies on the

Australian stock exchange (ASX) that are around for years without having much of an impact on the market, and in some cases, none at all.

A colleague who works for the Australian government entrepreneurial program used the term “zombies”; very appropriate!

We all get into the MedTech startup space to make an impact, not for a lifestyle.

Lifestyle aspirations are better served through a job in an established organisation; the pay is better!

So, if we start at the beginning, the Founder is often a technology-driven person, an academic or an engineer, who has limited and generally no experience with the business of

healthcare. Nor do they have experience with clinical trials, regulatory, reimbursement, stakeholder engagement and so on.

We often hear that the Founder has spoken with a “few” clinicians and gained positive feedback on their technology which is the motivation to set up a startup. This is so far

from what is required in reality. How do you know what the right questions to ask the clinician or patient are?

I have been involved in big Pharma programs where extensive market research including clinician and patient engagement was made, but the product failed due to poor uptake.

If these big companies can’t always get it right, imagine what it is like for a startup where the Founder(s) have never worked in healthcare?

So, in healthcare startups it is not about the Founder, (they often are part of the problem rather than of the solution), but rather about the team that has been created.

What collective expertise have you collected as the core of the company? It doesn’t have to be all employees. Some can be Advisors. As long as they can think strategically,

which means they have the necessary experience to be able to flag up judgements that are wrong!

I am not particularly in favour of Consultants, as they are expensive and they will answer the question you propose to them. But if you don’t know the correct question,

you can waste your money. And we all know how valuable money is to a startup.

And the other point I want to emphasise, is the ability to be and think strategically. This requires surrounding the core company with people that have done it, and ideally, more than once!!!

This is people who have worked in the healthcare industry at the appropriate position; look at their track record. Challenge them as to what their contribution was in relation to their claims.

I have been involved in many programs that have ended up in reaching the market. But it wasn’t just me; I was part of a team. And that means that my knowledge is based on a collective experience.

You should therefore ask, what part of the program the individual was involved with and make sure that experience is something you need. I cannot emphasise this enough.

Most importantly, make sure you get people you can work with!

Otherwise, get ready for a difficult time!!! When you take on an outsider, begin with a small project to see if you both are a good fit. Have a contract in place to ensure

that it is for that specific project and have a lawyer look at it.

Getting these quality people is difficult when you have little financial capability. Get creative! Use a little equity! Delay payment! What I have found is that generally

the best people are motivated by the potential of bringing an interesting product to market, not (only) driven by the remuneration. This is a major distinction between Advisors and Consultants.

When you have limited or no money, your bargaining chip can be equity. This is why Consultants are generally not the right fit……they want to get paid! I cannot or would not recommend how much

equity to give. It is what you are comfortable with. And talk with experienced colleagues who have gone through this experience.

From: The Founder’s Dilemma

“Choosing money:

A Founder who gives up more equity to attract investors builds a more valuable company than one who parts with less—and ends up with a more valuable slice, too”

When you have some money, you need to hire the best experts around. Again, set up a contract that has been reviewed by an experienced startup Lawyer. They often seem more expensive

due to upfront cost, but they will cost you less in the long term, both financially and most importantly, but also in terms of corporate survival.

I keep on mentioning strategy. Think of contract organizations that are strategic oriented. They are looking ahead and this is why they end up in costing less.

one US startup I worked with presents a great learning lesson. I had accumulated a significant amount of equity to join and direct the company. They had been in business

for 8 years and their revenue was around US$40K/year. I was brought on board and recruited a colleague to help establish a new business direction. The company was basically broke.

We pivoted the company such that the perception was significantly improved. We managed to get an acquisition offer of 15 cents in the dollar based on our valuation. We went to

the Chairperson and CEO and strongly recommended accepting the offer…they refused.

The company went bankrupt. And now the Chairman who invested millions is a real estate agent!

Another thing I have noticed, that the Founder, again, usually an Academic or Engineer, tends to focus on what they know. So many startups have a big technical team, and nothing

or very limited on the clinical and business side. These Founders focus on what they know, not what they don’t know. The reality is that technology folks should be sparingly brought

on board as employees for as long as possible. Bring them on initially as contractors! As a startup you don’t want to have to deal with HR matters; another thing that can kill you.

So, the bottom line is PEOPLE, PEOPLE, PEOPLE! And try to get the best people possible.

Defining your Minimally Viable Product (MVP)

The easiest part is the technology.

This is not to say it is easy but there are many experienced Contract-Design and Contract-Engineering companies around. You have to find one that suits you and your project.

Talk to a few of them and make sure they are experienced in what you are looking to achieve.

But the real problem, particularly with healthcare startups, is defining the market and the pathway to adoption. Healthcare, unlike other industries, is loaded with stakeholders;

makes things complicated. There are clinicians, patients, insurers, government, regulators, payers, nurses, carers, therapists, hospitals, and more. To be able to develop a good

market proposition with a higher chance of success, you need to be able to identify all of the relevant stakeholders. Not all of the ones listed may be relevant to your program

but you have to figure this out. All MedTech companies have multiple stakeholders and there also are multiple potential markets. Then you need to understand their drivers. This can

be very challenging with clinicians, as many are driven by different “levers” and they can often change their view! So you need to find clinicians that are Key Opinion Leaders, not

just in name but rather in affecting standards of care. This is important as through your technology, you are adding an enabler to a care pathway, so you are going to have to affect

it in some way to gain adoption. In some cases, this can take years. Doesn’t mean you shouldn’t be doing it but you and your organization need to be prepared for this, financially

and emotionally. Understanding the stakeholders will provide you the greatest insights into what your product/service should be providing. And you should begin doing this as early

as possible as the technology needs to fit the need, not the other way around.

By focusing on understanding the stakeholders, it allows you to define the stakeholder pathways and identifies the potential roadblocks to adoption. Being able to manoeuvre through

these obstructions as early as possible will ensure the faster pathway to adoption.

This is a major part of defining your pathway to the market. It isn’t easy to do, but there are people out there (not many) that are really good at this.

Other issues

-

INVESTORS – This is challenging in most countries but even more challenging in Australia. The pre-seed angel investors, seed round institutional investors, VCs, corporate ventures, all are difficult but if you have addressed the issues raised above you have a better chance of getting funding.

And there are good and bad investors.

Ideally, you want to obtain strategic investors. These are investors that not only money but also provide additional value. Maybe a missing expertise, may be a network of clinicians, may be a network of investors. These investors are the best. But I do recognise the challenge when you are fundraising. The reality is you have to be always in fundraising mode. It never ends, until you get to the stage of having a profitable business.

-

BOARD OF DIRECTORS – Do your homework. Don’t necessarily go for that Director who is a name on a whole stack of companies. Get ones that add value to your company. They can fill the gaps in terms of lack of expertise; a not so expensive way of doing this.

But make sure that they are “the real deal”. Some of the best potential Directors around are those that are not in the spotlight. Map out your strengths and weakness and look for Directors that can fill the weaknesses.

Some concluding remarks

You will notice that I have paid little attention to the technology. I have seen so many great technologies. Their ability to reach the market was actually controlled more by the

points that I have covered above.

And don’t forget that healthcare is an industry that is intrinsically risk-adverse and as a consequence notoriously slow to adopt innovations. It really advances through small

incremental changes.

Digital Health:

All the points above are just as relevant. In addition Digital Health has been very heavily driven by technologies. IT, sensors, mobile, etc… yet, when we take a step back, this

part of healthcare hasn’t yet shown a great return on investment. This may change but for now it is not impressive. The perennial difficulty to drive innovation in healthcare is

exacerbated in the case of Digital Health, a sector is heavily technology-driven.

I spent most of my US career on the East Coast. It was clear to me that it was driven primarily by business i.e. the “business of healthcare”. I spent the last year of my US time

in Silicon Valley. As a student of innovation, I felt I had to. I got very disappointed, however not really surprised.

I worked for one of the potential “poster childs” of Silicon Valley healthcare, Theranos.

It was clear to me after a very short time there, that they would not make it. They did not understand the business of healthcare. A number of times when I was talking to Elizabeth

Holmes, I tugged on my grey beard and said to Elizabeth “these grey hairs, I wasn’t given them, I earned them!”. That didn’t seem to affect her, as we can see by the results.